Projects

Recent Projects

Worldwide Venture Capital

We will be pleased to assist you no matter what your funding requirements are. If you have been turned down by banks or financial institutions, we can help. As project financiers, we pride ourselves in using creative ways to provide the funding you require during these difficult economic times.

Aknan Investments Co has been in the International Project Funding business since 1992, during that time our ability to evolve in these ever changing economic times has led to our success. We have continued while many financial institutions have failed, our proven track record is testament to that.

- Blandit fugit dicta quibusdam, maxime tempor

- Blandit fugit dicta quibusdam, maxime tempor

- Blandit fugit dicta quibusdam, maxime tempor

Public Listings

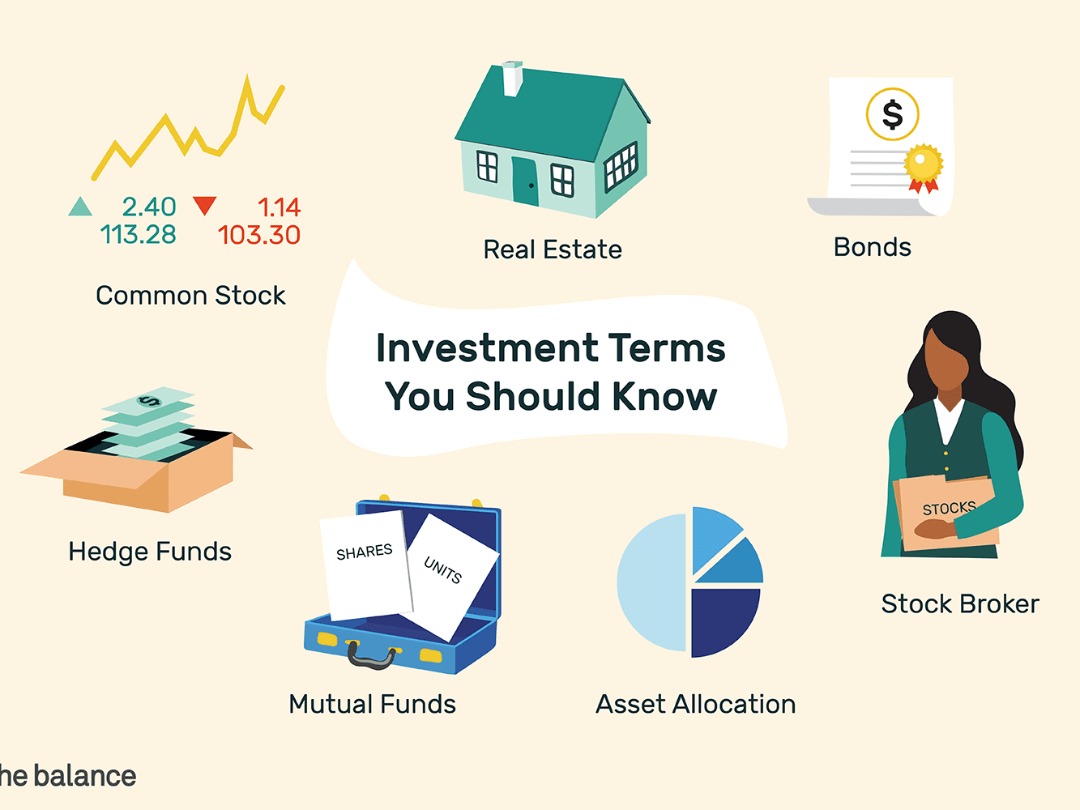

An initial public stock offering (IPO) referred to simply as an “offering” or “flotation,” is when a company (called the issuer) issues common stock or shares to the public for the first time. They are often issued by smaller, younger companies seeking capital to expand, but can also be done by large privately-owned companies looking to become publicly traded.

Common stock is a form of corporate equity ownership, a type of security. It is called “common” to distinguish it from preferred stock. Preferred stock is a special equity security that resembles properties of both equity and a debt instrument and generally considered a hybrid instrument. In the event of bankruptcy, common stock investors receive their funds after preferred holders, bondholders, creditors, etc. On the other hand, common shares on average perform better than preferred shares or bonds over time.

Common stock is usually voting shares, though not always. Holders of common stock are able to influence the corporation through votes on establishing corporate objectives and policy, stock splits, and electing the company’s board of directors. Some holders of common stock also receive preemptive rights, which enable them to retain their proportional ownership in a company should it issue another stock offering. There is no fixed dividend paid out to common stock holders and so their returns are uncertain, contingent on earnings, company reinvestment, and efficiency of the market to value and sell stock. Additional benefits from common stock include earning dividends and capital appreciation.

An IPO can be a risky investment. For the individual investor, it is tough to predict what the stock or shares will do on its initial day of trading and in the near future since there is often little historical data with which to analyze the company. Also, most IPOs are of companies going through a transitory growth period, and they are therefore subject to additional uncertainty regarding their future value.

In addition, once a company is listed, it will be able to issue further shares via a rights issue, thereby again providing itself with capital for expansion without incurring any debt. This regular ability to raise large amounts of capital from the general market, rather than having to seek and negotiate with individual investors, is a key incentive for many companies seeking to list.

Benefits of being a public company-

• Bolster and diversify equity base

• Enable cheaper access to capital

• Exposure and prestige

• Attract and retain the best management and employees

• Facilitate acquisitions

• Create multiple financing opportunities: equity, convertible debt, cheaper bank loans, etc.

- Blandit fugit dicta quibusdam, maxime tempor

- Blandit fugit dicta quibusdam, maxime tempor

- Blandit fugit dicta quibusdam, maxime tempor

Gold Investment

The World Gold Council supports the development of gold markets and helps investors understand how investments in gold can help them achieve their investment objectives. We work to expand the options for individual and institutional investors to access the gold market by working with the financial industry to develop and promote new offerings through direct and intermediated channels

Private Share Placement

Private placement of your companies shares through licensed stock trading companies is a commonly used method for raising capital and success in using this method can be achieved providing that ;

a) Your company being suitable for future listing.

b) Your company’s desirability to a future buy out candidate.

c) Your company’s business proposal being suitable to stimulate a desire for investors to buy it’s shares.

Companies in this area of capital provision differ greatly in the types of companies they will accept and minimum amounts they will accept to be raised.

Normally these companies only profit from selling your shares at a discount from the share price which can mean there may be no initial fees but the discounts vary significantly between companies . So once again ABP’s in depth knowledge of the companies to approach, will give you the best and most speedy solution .

Venture Capital

Venture capital, as an industry, originated in the United States and American firms have traditionally been the largest participants in venture deals and the bulk of venture capital has been deployed in American companies. However, increasingly, non-US venture investment is growing and the number and size of non-US venture capitalists have been expanding.

Venture capital has been used as a tool for economic development in a variety of developing regions. In many of these regions, with less developed financial sectors, venture capital plays a role in facilitating access to finance for small and medium enterprise (SMEs), which in most cases would not qualify for receiving bank loans.

In the year of 2008, while the Venture Capital fundings are still majorly dominated by U.S. (USD 28.8 B invested in over 2550 deals in 2008), compared to International fund investments (USD 13.4 B invested in everywhere else), there have been an average 5% growth in the Venture capital deals outside of the U.S- mainly in China, Europe and Israel. Geographical differences can be significant. For instance, in the U.K., 4% of British investment goes to venture capital, compared to about 33% in the U.S.

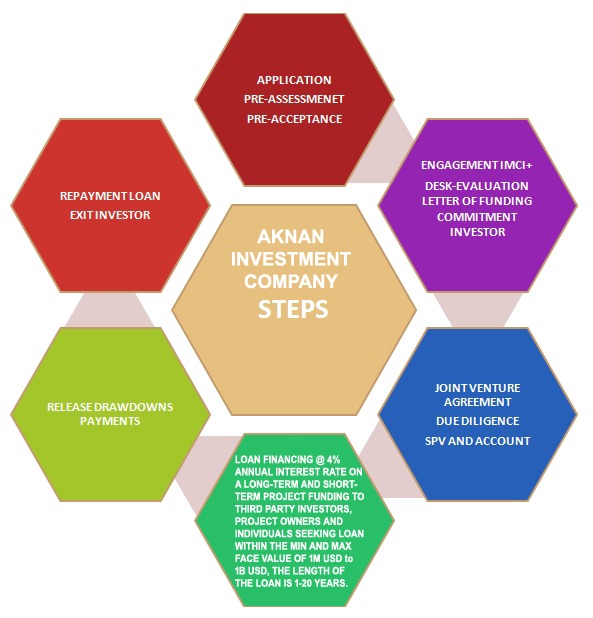

Joint Venture Project Funding

We are a leading edge Investment Company that understands the dilemma that is caused by the current economic turmoil for new and established companies alike when seeking finance and our mission is to provide solutions for our clients in a fast friendly manner.

Making an application to us could not be more simple and it will cost you nothing for us to let you know if we can be of service.

Applications from companies of all types and from anywhere around the world are welcome as are broker enquiries so click here to bring up the application, a solution may be easier than you imagine, so answer the questions click send and we will get back to you very quickly.

Please take a moment to check out the types of funding available so you can make the choice/s that best suits you when completing the application

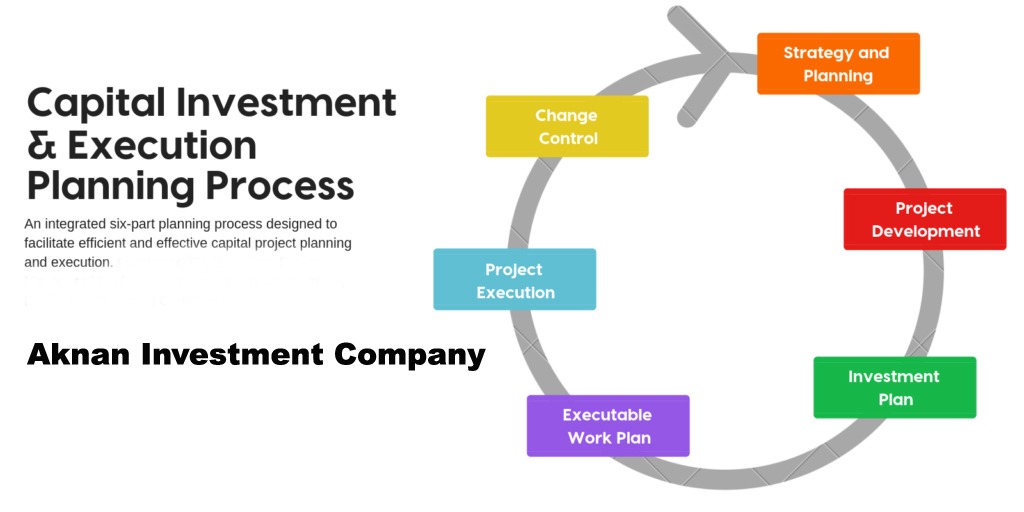

Capital Investment Project

A new capital investment project is important for the growth and expansion of a company. It is also important for the economy at large as it often leads to research and development. This type of project is one that is either for expansion into a new product line or a new product market, often called the target market.

A new product or a new target market could, conceivably, change the nature of the business. It should be approved by higher-ups in the business organization. A new project, either a new product or a new target market, requires a detailed financial analysis and the approval of possibly even the firm’s Board of Directors.

An example of a new product would be a new medical device that is conceived, researched, and developed by a company specializing in medical devices. Perhaps this medical device would tap into a target market that the company had not yet been able to reach.

Debt Financing

Reasonable Interest rates on Capital up to Min and Max face value of 1M USD to 1B USD, the Length of the Loan is 1-20 years.

• Food Production-Agriculture/

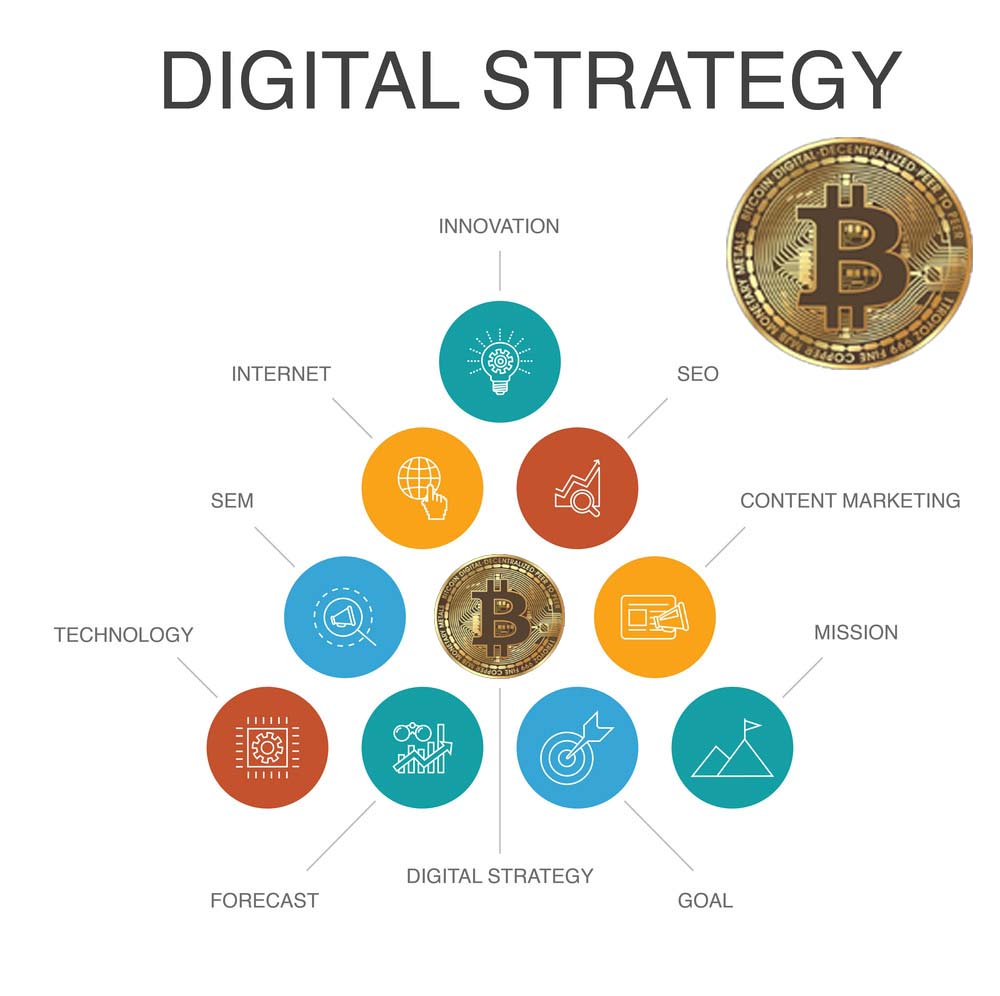

Digital Investment

A trusted authority on digital currency investing, Aknan Investment Company provides a secure access and diversified exposure to the digital currency asset class.

INVEST IN A DIGITAL FUTURE by selecting from our various pre-specified portfolios or, for more experienced investors, customize your portfolio to preference and get started with your next investment.

We Provide the Best Service in Industry

Add a line that tells users how easily they can get in touch with you